Surely, you have heard about USDT in the crypto world.

Tether is a cryptocurrency that aspires to maintain a 1:1 parity with the US dollar, which means that the tokens in circulation are backed by an identical quantity of US dollars, making it a stablecoin with a price tied to USD $1.00.

USDT was first issued on the bitcoin protocol via the Omni Layer, but it has subsequently moved to other blockchains as well. In fact, most of its supply is held on the Ethereum blockchain as an ERC-20 token.

It is also available on the TRON network, EOS, Algorand, Solana, among others.

Tether is a stablecoin, which is a sort of cryptocurrency designed to keep prices stable.

Origins

J.R. Willett outlined the prospect of creating additional currencies on top of the Bitcoin Protocol in a document released online in January 2012. (JR Willet is called “The Man Who Invented ICO”).

Willett went on to assist in the implementation of this concept in the cryptocurrency Mastercoin, to encourage the adoption of this new “second layer.” The Mastercoin protocol would provide the technological backbone of the Tether cryptocurrency, and one of the Mastercoin Foundation’s early members, Brock Pierce, would become a Tether co-founder. Craig Sellars, another Tether creator, was the CTO of the Mastercoin Foundation.

Tether’s predecessor, initially called “Realcoin”, was launched in July 2014 as a Santa Monica-based firm by co-founders Brock Pierce, Reeve Collins, and Craig Sellars. The first tokens were released on the Bitcoin network on October 6, 2014. Tether CEO Reeve Collins announced the project’s rebranding to “Tether” on November 20, 2014.

The firm also announced the launch of a private beta program that will enable a “Tether+ token” for three currencies: USTether (US+) for US dollars, EuroTether (EU+) for euros, and YenTether (JP+) for Japanese yen.

Why was USDT created?

You are probably asking how beneficial a cryptocurrency worth the same as a dollar can be. Especially now that we have the dollar and digital payment methods that use it.

In reality, a stablecoin like USDT makes a lot of sense when we consider the following:

- It does not place restrictions on you when making a transfer: USDT has all the benefits of a traditional cryptocurrency. This implies that you can transfer USDT anywhere in the globe with little difficulty and at a minimal cost.

- It provides a way to safeguard investments from traders on an exchange platform: A trader, for example, can purchase and sell bitcoin and then convert his balance into USDT at the end of his deals. In this way, it shields itself against fluctuations in bitcoin values until it can resume operations.

- Provides a safe payment platform, in terms of volatility: This is due to the cryptocurrency’s constant value of one dollar, making it perfect for payment systems when volatility is undesirable, but you still want to utilize a cryptocurrency.

How does Tether (USDT) work?

Tether is a stablecoin, a type of cryptocurrency that aims to keep cryptocurrency valuations stable, as opposed to the huge swings seen in the prices of other famous cryptocurrencies such as Bitcoin and Ethereum.

Instead of being utilized as a medium of speculative investments, this would allow it to be used as a means of trade and a form of wealth storage.

Tether was created particularly to provide consumers with stability, transparency, and low transaction fees by bridging the gap between fiat currencies and cryptocurrencies. It is tied to the US dollar and maintains a one-to-one value ratio with the US dollar.

Tether Ltd, the organization behind USDT, mints and burns the tokens from circulation based on their dollar reserves — Tether Ltd claims to have a 1:1 reserve ratio of USDT to USD stored in their bank account. As a result, USDT can trade at the same value as the US dollar.

Tether Ltd, in addition to giving US dollar exposure via USDT, also supports the Chinese Yuan (CNHT), the Euro (EURT), and gold ounces (XAUT).

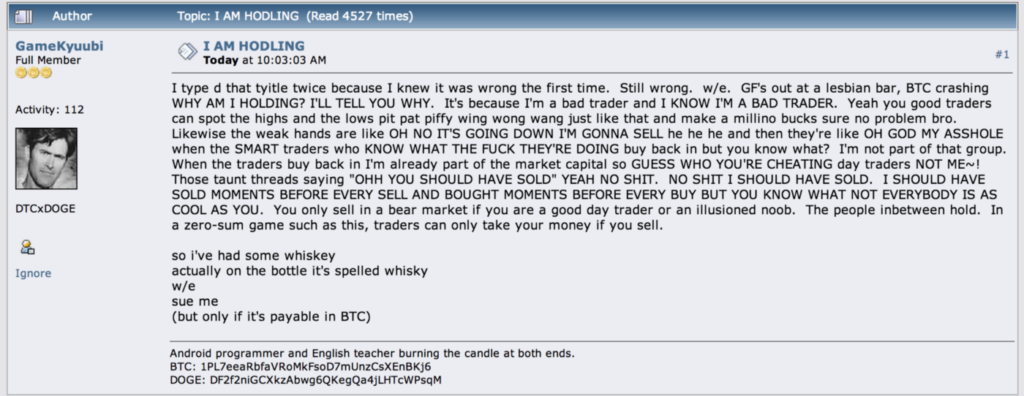

According to a survey conducted by CryptoCompare, a worldwide cryptocurrency market data source, Bitcoin to Tether trading continues to account for the vast majority of BTC exchanged into fiat or stablecoin.

In January 2022, USDT accounted for 55% of all bitcoin trading.

Controversy

Tether Ltd was allegedly hacked in November 2017, with $31 million in Tether tokens taken.

In January 2018, it struck another stumbling block when the required audit to guarantee that the real-world reserve was maintained did not take place. Instead, it announced its separation from the audit company, following which authorities issued a subpoena. Concerns have been raised about whether the corporation, which has been criticized of lacking transparency, has adequate reserves to support the coin.

In April 2019, New York Attorney General Letitia James charged iFinex Inc., parent firm of Tether Ltd. and operator of cryptocurrency exchange Bitfinex, with concealing a $850 million dollar loss of co-mingled customer and corporate money from investors.

According to court documents, these assets were entrusted to a Panamanian firm named Crypto Capital Corp. without a contract or agreement to manage consumer withdrawals.

After the money went missing, Bitfinex allegedly grabbed at least $700 million from Tether’s cash reserves to cover the difference.

The organizations stated in a statement that the papers “were produced in ill faith and are laced with fraudulent statements.”

On the contrary, we have been informed that these Crypto Capital sums have been seized and secured, rather than lost. We are and have been aggressively attempting to enforce our rights and remedies and get the release of those cash.

Unfortunately, the New York Attorney General’s office appears determined to undermine such efforts, to the detriment of our consumers.

Read this article for more much more details.

Advantages

- Transaction times: In a regular banking system, USD deposits and withdrawals typically take 1–4 business days to process. If the transaction occurs at night or on weekends when the bank is closed, the processing time may be extended. Tether transaction speeds are measured in minutes, which is advantageous for cryptocurrency traders who frequently wish to trade in minutes rather than days.

- Transaction fees: SWIFT (Society for Worldwide International Financial Telecommunication) transactions are costly, ranging from $20 to $30 or more. Especially if you are using a fiat currency that is not accepted by the exchange, then you will be charged a fee for Forex conversion as well as a percentage of the transfer amount. Tether charges no costs for transactions between Tether wallets.

- Price Stability: Cryptocurrencies are volatile when purchased using Tether rather than another currency. Currencies are not sufficiently stable as investments. Many exchanges do not accept fiat currency but will accept Tether.

- Sidelining: Taking no stand while anything is happening. “Cashing out” and waiting for a better chance or market timing. Have your Tether ready. There is no need to take risks or leave money on exchangers.

Disadvantages

- There are doubts about whether the Tether Ltd maintains a 1: 1 collateralization between the USDT tokens and their bank reserves: This is due to the fact that a full and public audit of this system has never been possible. As a result, the USDT faced a terrible position in 2017, with its value plummeting considerably below the 1: 1 ratio with the dollar, falling to 0.9: 1. Similarly, Tether Ltd has been embroiled in various controversies, including the Bitfinex hacking crisis and Tether’s own, both of which resulted in millions of dollars in damages.

- Centralization: Because it is a cryptocurrency managed by a firm, its functions are determined by them.

- Lack of anonymity: The requirement to make a bank deposit in order to produce the tokens reduces privacy and places your data in the hands of a firm.

- No Mining: Because of its asset-backed nature, Tether isn’t minable. New USDT is issued to verified users who make fiat currency deposits.

- There is no clarity on its implementation. There is no Github repository on its implementation on the Omni protocol. The only thing known is its smart contracts on Ethereum and EOS, the rest is not clear.

Conclusion

Tether has a role among cryptocurrency, filling a void when fluctuations are insufficient.

When with any cryptocurrency, be cautious and continue to research and monitor the news for any new information as you begin investing.