Ethereum is an open-source decentralized blockchain-based platform that allows individuals to conduct transactions and draw up contracts.

It has its own cryptocurrency, called Ether, and its own programming language, called Solidity.

As a blockchain network, Ethereum is a decentralized public ledger for verifying and recording transactions. The network’s users can create, publish, monetize, and use applications on the platform.

The most fascinating aspect of Ethereum is that the code published on its blockchain cannot be changed, modified, or hacked.

It is a decentralized programmable blockchain-based software platform, not simply a blockchain.

Ethereum was established in the summer of 2015 with the goal of broadening the spectrum of blockchain and cryptocurrency applications beyond Bitcoin’s initial scope, including permissionless financial services, crowdfunding, and new organizational structures.

Origin

Ethereum was initially described in a white paper by Vitalik Buterin, a programmer, in late 2013 with a goal of building decentralized applications.

Buterin argued to the bitcoin core developers that Bitcoin and blockchain technology could benefit from applications other than money, and that a more robust language for application development was needed, which could lead to the blockchain being used to store real-world assets like stocks and property. He recommended the construction of a new platform with a more sophisticated programming language, which would later become Ethereum, after failing to reach agreement on how the project should proceed.

Formal development of the software began in early 2014 through a Swiss company. The basic idea of putting executable smart contracts in the blockchain needed to be specified before the software could be implemented.

Several codenamed prototypes of Ethereum were developed over 18 months in 2014 and 2015 by the Ethereum Foundation as part of their proof-of-concept series.

In July 2015, “Frontier” marked the official launch of the Ethereum platform as Ethereum created its “genesis block.”

Since the initial launch, Ethereum has undergone several planned protocol upgrades, which are important changes affecting the underlying functionality and/or incentive structures of the platform.

After the Constantinople upgrade on 28 February 2019, there were two network upgrades made within a month late in the year: Istanbul on 8 December 2019 and Muir Glacier on 2 January 2020.

There have been two network upgrades in 2021. The first was the Berlin upgrade, implemented on 14 April 2021. The second was London, which took effect on 5 August. The London upgrade included Ethereum Improvement Proposal (“EIP”) 1559, which introduced a mechanism for reducing transaction fee volatility. The mechanism causes a portion of the Ether paid in transaction fees each block to be destroyed rather than given to the miner, reducing the inflation rate of Ether and potentially resulting in periods of deflation.

How does Ethereum work?

You might have heard that the Bitcoin blockchain is a lot like a bank’s ledger, or even a checkbook. It’s a running tally of every transaction made on the network going back to the very beginning — and all the computers on the network contribute their computing power towards the work of ensuring that the tally is accurate and secure.

The Ethereum blockchain, on the other hand, is more like a computer: while it also does the work of documenting and securing transactions, it’s much more flexible than the Bitcoin blockchain. Developers can use the Ethereum blockchain to build a huge variety of tools — everything from logistics management software to games to the entire universe of decentralized applications (which span lending, borrowing, trading, and more).

Ethereum uses a virtual machine to achieve all this, which is like a giant, global computer made up of many individual computers running the Ethereum software. Keeping all of those computers running involves investment in both hardware and electricity by participants. To cover those costs, the network uses its own cryptocurrency, Ether (or, more commonly, ETH).

ETH keeps the whole thing running. You interact with the Ethereum network by using ETH to pay the network to execute smart contracts. As a result, the fees paid in ETH are called “gas”.

Use cases

- Decentralized finance (DeFi): An open and global financial system built for the internet age — an alternative to a system that’s opaque, tightly controlled, and held together by decades-old infrastructure and processes. It gives you control and visibility over your money. It gives you exposure to global markets and alternatives to your local currency or banking options. DeFi products open up financial services to anyone with an internet connection and they’re largely owned and maintained by their users. So far tens of billions of dollars worth of crypto has flowed through DeFi applications and it’s growing every day.

- Non-fungible tokens (NFTs): Tokens that we can use to represent ownership of unique items. They let us tokenise things like art, collectibles, even real estate. They can only have one official owner at a time and they’re secured by the Ethereum blockchain — no one can modify the record of ownership or copy/paste a new NFT into existence. NFTs and Ethereum solve some of the problems that exist in the internet today. As everything becomes more digital, there’s a need to replicate the properties of physical items like scarcity, uniqueness, and proof of ownership. Not to mention that digital items often only work in the context of their product.

- Decentralized autonomous organisations (DAOs): Think of them like an internet-native business that’s collectively owned and managed by its members. They have built-in treasuries that no one has the authority to access without the approval of the group. Decisions are governed by proposals and voting to ensure everyone in the organization has a voice. There’s no CEO who can authorize spending based on their own whims and no chance of a dodgy CFO manipulating the books. Everything is out in the open and the rules around spending are baked into the DAO via its code.

Advantages of Ethereum

Aside from decentralization and anonymity, Ethereum also has various other benefits, such as a lack of censorship. For example, if someone tweets something offensive, Twitter can choose to take it down and punish that user. However, on an Ethereum-based social media platform, that can only happen if the community votes to do it. That way, users with different viewpoints can discuss as they see fit, and the people can decide what should and shouldn’t be said.

Community requirements also prevent bad actors from taking over. Someone with ill intentions would need to control 51% of the network to make a change, which is nearly impossible in most cases. It’s much safer than a simple server that can be broken into.

It’s also getting easier than ever before to acquire Ether. Companies like PayPal and its Venmo subsidiary support purchasing crypto with fiat currency right within the application. Considering the millions of customers on each platform, they’re bound to get involved sooner rather than later.

Disadvantages of Ethereum

While it sounds like the perfect platform, Ethereum has a few key issues that need to be worked out.

The first is scalability. Buterin envisioned Ethereum the way the web is now, with millions of users interacting at once. Due to the PoW consensus algorithm, however, such interaction is limited by block validation times and gas fees. Furthermore, decentralization is a hindrance. A central entity, like Visa, manages everything and has perfected the transaction process.

Second, there is accessibility. As of the time of writing, Ethereum is expensive to develop on and challenging to interact with for users unfamiliar with its technology. Some platforms require specific wallets, which means that one must move ETH from their current wallet to the required wallet. That’s an unnecessary step for users ingrained in our current financial ecosystem and not beginner-friendly in the slightest.

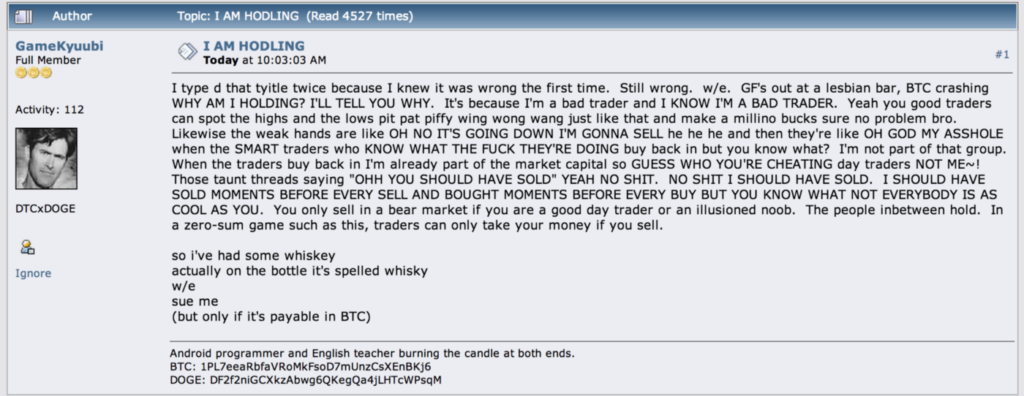

Sure, PayPal is adding crypto support, but users can’t do much aside from holding it there. The platform needs to integrate with DeFi and DApps to increase accessibility in a meaningful way.

The platform does have some well-written documentation on the matter — another key way to bring in more users. But the act of actually using Ethereum needs streamlining. Learning about blockchain is very different from using it.